Chatbots in Banking: The Next Big Thing You Need to Know About

Chatbots in banking are a great way to reduce their overall banking operation task to a maximum extent.

Banking chatbots help the customers to do any financial transactions easily with voice or text.

Chatbots are the most preferred technology, and it’s developing rapidly with unique features to ease both customers and bank management.

Moreover, Chatbots have proved to improve customer satisfaction.

Banking sectors hold highly confidential information, and one must not take the risk by deploying a chatbot of any glitches.

To overcome this, a well-tested banking chatbot that can maintain the reputation of the bank needs to be in place.

Furthermore, people no longer wanted to stand in a long queue to complete their banking operations. Net banking, mobile banking, and now chatbot banking is highly preferred by the customers.

To illustrate, Whatsapp chatbot banking is the most convenient for people; they can easily know all their bank accounts’ basic details by just selecting a number. Customers want easy and fast service across whatever device they use.

How chatbots can help in Banking Industry

You can’t ignore the contribution of chatbots in the banking industry. Years ago, banking chatbots were already in place; Bank of America and ATB Financial are the early adopters of AI chatbots in 2018. Chatbots are advancing with unique features to ease the process further. Whatsapp Chatbot is one such example.

As per Juniper Research, it’s estimated that 90% of interactions in banks got automated using AI chatbots.

It was also found that people prefer more going with chatbots than asking queries with a human agent. Chatbots are more robust and efficient in responding than humans.

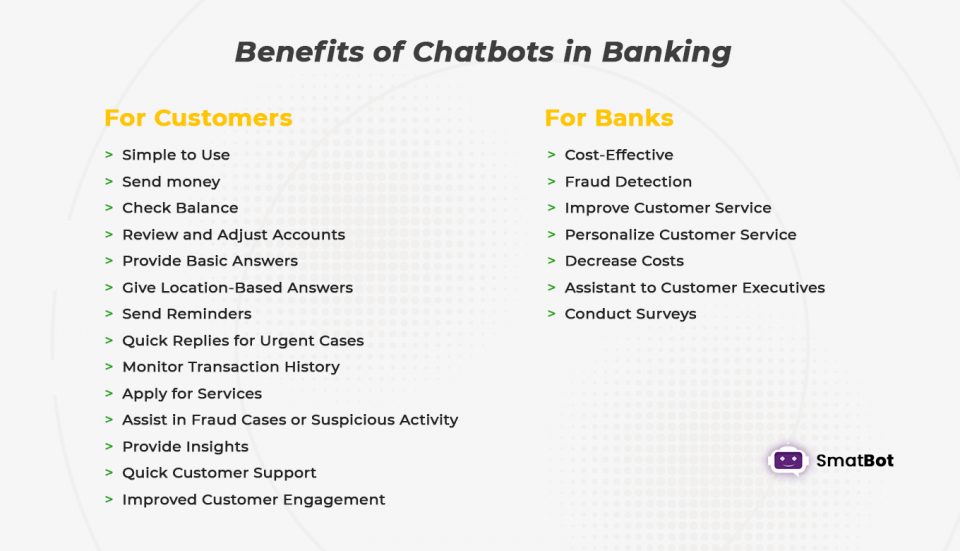

Benefits of chatbots in banking

Banks or any financial institutions which deployed chatbots in their banking operation will benefit from:

Banking chatbot benefits for customer

Simple to Use:

Chatbots can be easily integrated with any platforms such as Whatsapp, applications, websites, messenger, and others. So it’s effortless for the users to interact with banks in their preferred platforms more smartly. Below are some of the ways customers can efficiently use banking chatbots:

Send money:

Customers can request money from people, and similarly, they can pay the same in just one click after you have authenticated with some of your account details that will not take much time.

Check balance:

In Whatsapp chatbots or any other chatbots, they will provide you with a list of actions you need to select just the number before that action. It will take you to the flow to complete that process. For checking balance also you just need to enter the number to get your balance.

Review and adjust accounts:

You can ask for transaction history, mini statement, clear your dues, and ask for adjustments if you find fraudulent activities in your account.

Provide basic answers:

You can check your account balance, credit card due date, credit card or account statement, credit card cash limit, your last ten transactions, and many other details by just following the conversational flow. You can even type your query and send it; they will get back to you with the best possible solution.

Give location-based answers:

It can help you in locating the nearest bank branches, ATMs based on your location. And provide you every detail by considering your current location.

Send reminders:

Customers will get reminders to pay their card bills before the due date, notifications on exclusive deals relevant to them, or notifications for any pre-approved offers.

Quick replies for urgent cases:

You can-

- Quickly block your credit/ debit card in case of loss.

- Quickly get noticed for fraudulent transactions and many more such emergency cases;

- And easily get replies to your queries.

Monitor transaction history

Instantly, you can get to know your account summary details. Get statements and many more details in a few entries of numbers.

Apply for services:

It can notify you of any pre-approved offers, FD/RD services, cheque services, provide you details about any product /services specific to your account, and help you apply for any service by answering the probable queries for that action.

Assist in fraud cases or suspicious activity:

Whenever you come across any fraudulent activities in your account, chatbots can help you take all possible actions before it gets worse. Help you in blocking that account and provide you complete information of the transaction details.

Provide insights:

Overall it helps you in gaining complete insights into your accounts, managing and taking necessary actions.

Quick Customer Support:

Many times customers get fed-up while connecting through a customer executive via IVR or on an email. Chatbots can be instant support for them; it provides answers in seconds and connects you with human agents for automatically solving complex queries.

Improved customer engagement:

Chatbots provide complete assistance and suggest new offers which suit them. Getting instant solutions to your financial issues helps customers, making them more engaged with the products.

chatbot benefits for Banks

Cost-effective:

Chatbots provide 24/7 support and provide instant support to customers, which increases customer satisfaction. It reduces the number of human employees required to handle customer queries. Also, chatbots can handle multiple chats at the same time with accuracy.

As per Accenture research, 57% of companies accept that chatbots can bring large ROI with less effort.

Fraud Detection:

In banks, they often complain about credit cards’ illegal transactions and account deduction without their notice. Chatbots can help in these suspicious transactions and frauds; chatbots can instantly intimate every activity of the card and account.

Improve customer service:

Deploying chatbots in banking and other financial institutions will be great for both banks and customers. Customers can instantly respond to their queries round the clock, and on the other side, banks can easily handle ample questions immediately.

Personalize Customer Service

Customers are more inclined towards the brands with special attention or personalized experience. Using data of the customers, chatbots can provide a personalized experience to the customer based on their requirements and preference (after taking consent from the customer to access data). Also, customers no need to wait in long queues.

Decrease Costs:

As per Juniper Research, it’s estimated that cost savings from chatbots is $209M in 2019 and will reach $7.3B worldwide by 2023. By some reports, financial institutions can experience a cost savings of 22 % by 2030, representing $1 trillion in improved cost savings using AI.

Assistant to customer Executives:

Chatbots can handle level 1, and level 2 answers and transfer complex queries to human agents. All it does automatically help the human agents to spend their time handling complex queries and skip repetitive tasks. It will increase the overall performance of customer executives.

Conduct Surveys:

Chatbots using the personal experience of customers can estimate the problem encountered by the customer. Also, they conduct surveys, feedback, and take reviews to understand customer needs better and provide necessary solutions to them.

Chatbot Use Cases in Banking

- Customer Service

- Feedback Collection

- Lead generation and qualification

- Personalized marketing strategies

How Can you Start with Chatbots in Banking?

1. Know the limitations

It comes under a primary factor to consider while selecting a chatbot for your business.

When you have the right insights about chatbot limitations, capabilities, and chatbot challenges, you can set the right expectations to achieve your goals.

2. Check for Security:

There are some companies where their foundation is based on data security, especially the banking sector. Banks hold confidential data; they can’t afford a little mistake due to chatbot dysfunction. Security is a primary concern for both banks and their customers. So selecting the right chatbot will only benefit you. Otherwise, you may ruin your brand image and will be at a loss.

3. Authentication During Transactions:

It’s vital in banking because regularly, people do transactions in banks. The banking officials must ensure strict authentication during transactions to avoid any difficult circumstances.

4. Check for Chatbot Specialization:

As in the banking sector, there will be many use cases. Some are basic, like lead generation for loans and related to customer service. Some are specific to specific products; you must check for the chatbot’s capabilities to meet your needs.

5. Test comprehensively:

Generally, there are many cases where chatbots failed or didn’t meet the need. In banking, there is no such scope of failures. So before implementing, you must test as many times as possible for every function. It helps you to avoid getting ashamed in front of your customers or minimize any future risks.

6. Be Consistent across channels:

Chatbot integration is relatively easier than messaging apps. Still, you may face some challenges to deploy the same chatbot across various platforms. You must check for the consistency of the service across multiple platforms and channels.

Banking Chatbot Future

The introduction of chatbots in banking has created a whole new experience for both customers and banks. Chatbots made executing banking operations so easy for bank executives and also for customers to access their accounts.

Customers are now more engaged with banks than before. Instead of standing in a long queue, now they can perform banking operations instantly in a few clicks.

Banks or any financial institutions can’t take a risk in selecting chatbots. They need to look for all parameters and verify them many times to confirm it, especially regarding the customer accounts’ security and privacy.

If you are looking for such chatbots that will not regret you. SmatBot Chatbot is the right choice for you.

Try SmatBot banking chatbot now for a 14-day free trial